Aguascalientes

On March 28 the official organ of the State of Aguascalientes published the benefits for taxpayers of the Payroll Tax [in Spanish: el Impuesto sobre Nómina] (ISN) of the said state:

• Payments for the months of April, May, and June are deferred up to 8 equal monthly installments. In order to be entitled to this benefit, the taxpayer must request it in writing in the State Ministry of Finance before the payment due date. This will not incur fines, restatements, or surcharges.

• A 30% discount is granted for those payments made for the months of April through December 2020, and for those taxpayers who have 20 active workers in each of those months, provided that the remaining payment is made in a timely manner.

Baja California Sur

On March 23 the Government of the State of Baja California Sur published in the Official State Gazette the benefits for taxpayers of the Payroll Tax of the said state:

• The obligation to file a monthly return for the months of March, April, and May is deferred. The same must be filed on the 31st for the months of August, October, and December respectively.

Baja California

Until now, no fiscal stimulus or incentives regarding employment matters have been published in the state. Only state audit reports are suspended.

Campeche

To date, no fiscal stimulus or incentives regarding employment matters have been published in the state. Only state audit reports are suspended.

Mexico City

On March 20, the Official Gazette of Mexico City [in Spanish: la Gaceta Oficial de la Ciudad de México], published the benefits for taxpayers of the Payroll Tax:

• The term for filing returns is extended, and payments must be made during the month of April 2020 and may be completed until April 30 of the same year.

Coahuila

At present, no fiscal stimulus or incentives regarding employment matters have been published in the state. Only state audit reports are suspended.

Colima

On March 19, 2020, a fiscal benefit for taxpayers in Colima state was announced regarding payment of the Payroll Tax which can be made until Thursday April 30, 2020.

Administrative incentives:

If the Payroll Tax has an obligation date of March 17, 2020 and April 17, 2020, taxpayers can file their payment return without surcharges without being subject to a tax audit notice until April 30, 2020 from the competent authority.

Chiapas

To date, no fiscal stimulus or incentives regarding employment matters have been published in the state. Only state audit reports are suspended.

Chihuahua

On April 08, 2020 the Government of the State of Chihuahua announced that the Secretary of the Treasury submitted a fiscal stimulus plan.

Companies that have maintained at least 70% of their registered workforce by the end of February 2020 will be granted a remission of 100% of the Payroll Tax corresponding to the months of April and May, if it relates to companies with fewer than 50 employees.

Moreover, a remission of 50% in April and May of the Payroll Tax for companies that have 51 to 90 employees will apply, as well as a 50% extension in April and May for companies with more than 90 employees, in order to allow them to pay until November and December 2020.

Durango

On March 24, 2020, a decree that contains administrative incentives and fiscal incentives for state taxes was published. It is of public interest and applies throughout the State of Durango. It will be in force until the day following its publication and for the next 12 weeks.

Specific beneficiaries include companies, individuals, and legal entities that can show proof of transactions before February 23, 2020. The following outlines:

Administrative incentives:

• An extension of up to 6 months in the payment deadline of the state tax agreement and raised capital resulting from state audits.

• An extension of the payment deadline of the tax agreement and/or state rights.

Fiscal incentives:

• An exemption of up to 50% of the Payroll Tax during the period the decree is in force.

• An exemption of up to 75% of the Payroll Tax for micro, small, and medium-sized companies [in Spanish: MIPYMES], businesses that institute measures that facilitate the procurement of goods and services.

Requirements:

Companies must make a free format submission in writing to the Secretariat of Economic Development [in Spanish: la Secretaria de Desarrollo Económico] in person, or by e-mail: sedeco@durango.gob.mx, and attach the following:

I. Name of applicant

II. Name of legal representative, if applicable

III. Address

IV. Phone number

V. E-mail

VI. Registration number in the Federal Taxpayer Registry

VII. Copy of the articles of incorporation, if a legal entity

VIII. Copy of power of attorney from legal representative, if applicable

IX. Evidence of preventive measures and health protocols applied from the outset of the contingency

X. Calculation of economic impact suffered until the application was completed, in accordance with monthly Income Tax returns

XI. Last payment statement of installments from the Mexican Social Security Institute [in Spanish: IMSS] before the outset of the contingency

The Secretariat of Economic Development must issue the respective resolution in a term no greater than 5 business days from the day following the receipt of the application with all the requirements.

Guanajuato

Governmental Decree number 44, Article 3 (Official Organ of the Government of the State of Guanajuato), published the following administrative incentives:

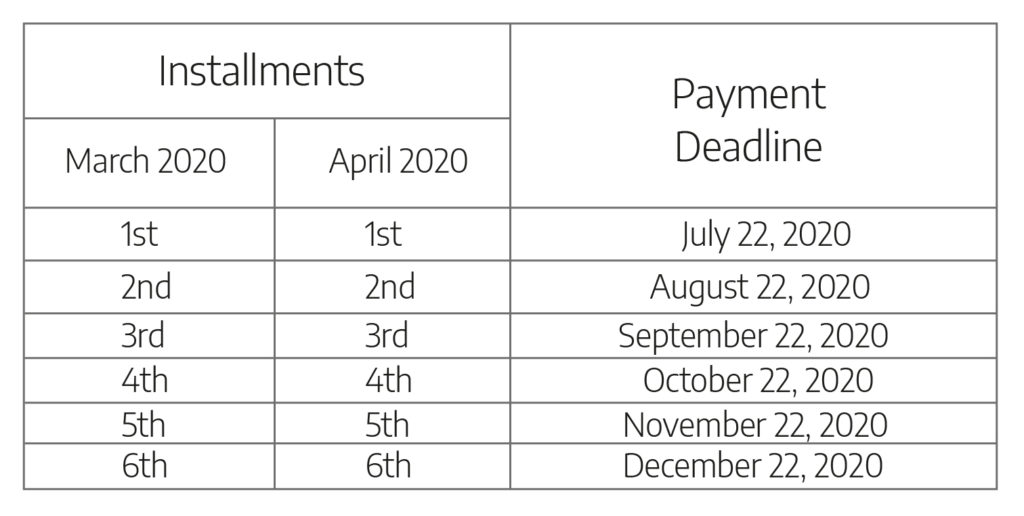

A payment of up to 6 installments corresponding to the months of March and April 2020:

Guerrero

The Official Organ of the Government of the State of Guerrero published a Special Agreement in which economic and fiscal measures were approved for companies and for the residents of the State of Guerrero stemming from the COVID-19 health contingency. The following is regarded as a fiscal stimulus:

• A 50% stimulus during March and April of this year on the Payroll Tax [in Spanish: Impuesto sobre Remuneraciones], as well as an additional two-month extension for the filing of the monthly returns from the aforementioned months, along with additional taxes.

Hidalgo

On March 26, 2020, the Official Organ of the State of Hidalgo published the First and Second Agreement regarding the following stimulus relating to the Payroll Tax:

• A remission of 50% for private sector taxpayers for the months of March and April 2020, provided that the taxable base is in the range of $0.01. to $500,000.00 (it must correspond to the parameters of previous returns of the said tax, using February 2020 as a point of reference).

• A remission of 5% for private sector taxpayers whose taxable base is incurred in the months of March and April 2020 and is greater than $500,000.00 (it must correspond to the parameters of previous returns of the said tax, using February 2020 as a point of reference).

Jalisco

To date, no fiscal stimulus or incentives regarding employment matters have been published in the state. Only state audit reports are suspended.

Mexico State

On April 26, 2020 a state executive order was published which grants fiscal benefits related to the Payroll Tax [in Spanish: el Impuesto sobre Erogaciones por Remuneraciones] for personal work.

Tax incentives:

• A 50% subsidy in the Payroll Tax on the total amount of taxes incurred in the month of April 2020.

The agreement only takes into account those companies that comply with the following:

• Up to 50 hired employees as of 31/03/2020

• No reduction in their workforce

• The tax must be paid by May 11, 2020 at the latest

• This benefit does not apply to public entities

Michoacán

The website of the Ministry of Finance of Michoacán published their Emergency Plan to protect the finances of Michoacán families. The following relates to the State Payroll Tax [in Spanish: el Impuesto Estatal sobre Nómina]:

A 100% subsidy during the months of March, April, and May for SMEs [in Spanish: Pymes] for companies with fewer than 50 employees and that are directly related to the tourism sector (restaurants, hotels, spas, travel agencies).

Morelos

On March 20, 2020 the Government of the State of Morelos published a fiscal benefit regarding a deferral in the payment obligations of the Payroll Tax for the months of March, April, and May 2020, which must be made by June 30, 2020 at the latest in order not to incur fines or surcharges.

Nayarit

On April 01, 2020 the Official Organ of Nayarit published the Administrative Agreement to which various fiscal benefits are given to taxpayers:

Taxpayers that, under the terms of Title Three, Chapter IV of the Finance Act of the State of Nayarit, have the obligation to pay the Payroll Tax, and will be guaranteed the following concessions and incentives of a fiscal nature:

a) Payments for the months of March, April, and May 2020 are deferred and will cover the period from July to December 2020; according to the guidelines that will be issued by the Secretariat of Administration and Finance [in Spanish: la Secretaría de Administración y Finanzas].

b) There is an interruption in the terms and deadlines of audit reports with regard to the Payroll Tax during the period from April 01 to 30, 2020.

c) A remission of 100% of the surcharges for taxpayers who report any debt.

d) A remission of 50% in fines for pending audit reports.

e) The period of validity of subsections c) and d) will be from April 01 to June 30, 2020.

Oaxaca

On March 25, 2020 the Governor of the State of Oaxaca issued a decree whereby a fiscal stimulus worth as much as 50% of the Payroll Tax will be granted in the second quarter of 2020 to those companies that provide evidence through 2019 federal tax returns that their income has decreased 50% or more. To be subject to this stimulus, companies must file a petition with the Ministry of Finance and attach the monthly returns filed with the Tax Administration Service [in Spanish: SAT], in the second half of May 2020.

Puebla

On April 12 the Governor of the State of Puebla published the following:

• A remission of the Payroll Tax for 17,844 small businesses that have 1 to 10 employees, in the period from April to December 2020.

• A remission of 50% of the Payroll Tax for 4,274 small businesses with 11 to 50 employees, from April to September of this year.

• There will be a remission of the Payroll Tax for businesses with more than 51 employees in the months of April to June, but they must file their return in July.

• In addition, state audit reports are suspended, and moreover, employers are urged to provide compensation that corresponds to the employment relationship during the period in which the contingency lasted and that aided in the propagation and infection of the COVID-19 virus.

Querétaro

To date, no fiscal stimulus or incentives regarding employment matters have been published in the state. Only state audit reports are suspended.

Quintana Roo

On March 24, 2020 the Government of the State of Quintana Roo published an emergency plan whereby it will grant a a deferral in the payment obligations of the Payroll Tax for the months of March, April, and May 2020, which must be paid in the months of October, November, and December respectively.

For those taxpayers who choose to make Payroll Tax payments in a timely manner, a remission of 20% will be granted for those payments made in March, April, and May.

Those benefits apply provided that the company is up-to-date in its fiscal obligations and retains the average number of employees equivalent to the same month from the previous year.

San Luis Potosí

On March 23, 2020, the Government of the State of San Luis Potosí published through its official webpage a tax concession for extending the payment of the Payroll Tax to July 15, 2020 for the months corresponding to March through June.

Moreover, incentives of 100% will be provided from the Payroll Tax that are incurred in the months of March to June 2020 (companies that have up to 50 employees).

Sinaloa

At present, no fiscal stimulus or incentives regarding employment matters have been published in the state. Only state audit reports are suspended.

Sonora

On March 25, 2020 the Official Gazette of the State of Sonora published Article Ten of the following fiscal stimulus:

• A temporary exemption of 50% in the Payroll Tax for companies with 50 employees or less.

Tabasco

To date, no fiscal stimulus or incentives regarding employment matters have been published in the state. Only state audit reports are suspended.

Tamaulipas

The State Government announced a tax and economic incentive plan for companies due to COVID-19 which is currently pending publication.

Tlaxcala

At present, no fiscal stimulus or incentives regarding employment matters have been published in the state.

Veracruz

The official Gazette of the State of Veracruz published the following administrative incentives:

A suspension in the terms and deadlines for on-site inspections and house calls stemming from its authority to countercheck in state matters.

The payment of the Payroll Tax corresponding to March and April 2020 is postponed from July through December 2020, and is subject to the following conditions:

• A taxpayer that is up-to-date in its state tax obligations at the time of receiving the benefit, with respect to the Payroll Tax.

• The total taxable base of individuals or legal entities subject to the payment of this tax that is part of the remuneration of 50 employees or less.

• The taxpayer promises not to carry out any unjustified dismissals during the period in which the health emergency lasts resulting from the propagation of the COVID-19 virus.

Yucatán

On Wednesday April 01, a decree was published that defined the administrative incentives and fiscal stimulus with regard to the Payroll Tax.

• A 50% discount on the Payroll Tax owed for the months of March and April. The remaining 50% will be deferred payments from July to December 2020.

Zacatecas

The website of the Ministry of Finances of the State of Zacatecas published the following fiscal incentives relating to the State Payroll Tax:

• A remission of 100% for companies with fewer than 20 employees

• A reduction of 50% for companies that have 21 to 40 employees.

• A remission of 100% on the Tax on Hospitality Services [in Spanish: el Impuesto Sobre Servicios de Hospedaje] for the months of April and May 2020.

• A remission of 100% on Payroll Taxes [in Spanish: Impuesto Sobre Nóminas] to Municipal Administrations and drinking water service providers.