The main changes that will be instituted as of January 2020 are the following:

Aguascalientes:

The ordinary interest rate increased from 2% to 2.5% which will be levied and paid on contributions made in cash for remunerations for work performed by an employee.

Baja California:

The surtax for calculating the Payroll Tax [in Spanish: el Impuesto Sobre Remuneración al Trabajo Personal] is modified from .63% to 1.2%. The collected income will be allocated to the state for higher education. The ordinary rate remains at 1.8%.

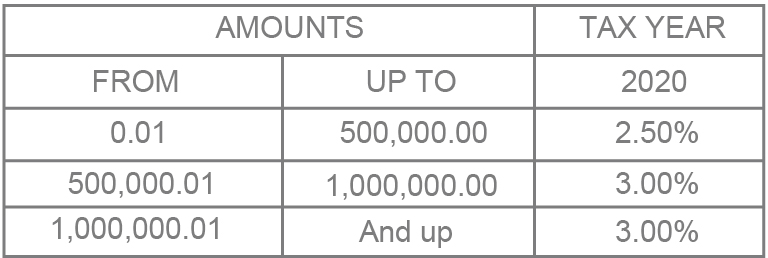

Hidalgo:

The Federal Tax Law [in Spanish: la Ley de Hacienda del Estado] establishes in Article 24 that the Employee Payroll Tax [in Spanish: el Impuesto Sobre Nóminas] be paid applying a rate of 3%. However, this rate will come into effect more broadly during the 2021 tax year.

The following procedure will be utilized during the 2020 tax year:

Puebla:

The ordinary interest rate increased from 2.5% to 3% which will be applied to contributions on remunerations for work performed by an employee.

Sinaloa:

The frequency with which tax returns must be filed has been modified. It changes from bimonthly to monthly, starting in January 2020. Furthermore, contributions made for the remuneration of imputed income is taxed. For tax returns starting in May, information regarding declared contributions must be filed by means of an attachment, in accordance with the generally applicable regulations.

Yucatán:

Section ninety regarding the obligation to withhold taxes for the provision of services is added to the General Finance Law [in Spanish: la Ley General de Hacienda].

Under the General Finance Law with regard to the Employee Payroll Tax in Article 24, the ordinary rate has increased to 3%. However, pursuant to Decree 155/2019 of the first transitory provision, it will come into effect as of January 2021.

The following obligations in February are in addition to the previously mentioned changes:

Aguascalientes:

Information regarding parties that may have made payments for remunerations by means of an annual Payroll Tax Return must be submitted within two months following the end of the fiscal year in question.

Guanajuato:

Information regarding parties that may have made payments for remunerations must be submitted by February 28 at the latest.

Querétaro:

The Payroll Information Return must be filed yearly by February at the latest.

Veracruz:

The Payroll Tax Contributions Return must be filed in February of the following year.

Quintana Roo:

In accordance with the provisions from Article 25 Bis Section II and III of the Quintana Roo State Tax Code, taxpayers are obligated to disclose information, and they must file a notice of opinion on the last day of February of the year following the reported results for the fiscal year.

Taxpayers of this state that contract the provision of services of employees by means of a third party must file a notice that designates the competent tax authority within the first two [sic] for the following fiscal year.

Please contact us if you have any question on this matter and we will be pleased to assist you.