As we approach to the end of the year there are several obligations to consider previous year end closing, one of those obligations is the Electronic invoice (CFDI) payments made for wages or assimilated to wages, due the issuance of the receipts is a requirement to apply the deduction on the annual income tax return.

This are some cases to be consider for payroll paid to the employees:

1.- The CFDI issued by a remuneration salary concept and in general for the subordinate personal services offered, they must comply with any complement published at the SAT portal.

2.- Submit the employees or assimilated to wages the XML file corresponding to payroll receipts, this should be send as follow:

- Through an employee e-mail address

- Through a website

In case the employee have no access to any of the above statements the employees should provide every semester the tax receipt in the mentions terms.

3.- Provide certificate and CFDI of the total amount of travel expenses paid last year (exempt) to the employees at the latest February 15th of every year.

4.- Reconcile issue payroll tax receipt versus the SAT portal.

5.- Review that all CFDI’s are as per attachment 20 published at the SAT authorities.

6.- Review that both amounts are the same between CFDI versus accounting information.

7.- Review randomly the payroll tax receipt validation into the SAT portal.

8.- The deadline to file the Annual tax return is on February 15th, 2017; otherwise if this is not file in the time established will be not be deductible; Additional it is required to calculate the income tax for the employees that apply, therefore it should be previously requested a letter indicating that they will file their own annual tax return, the employer is obligated to provide the income and withholding letter to the employee.

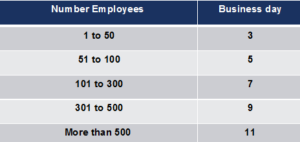

9.- It is important to mention that to issue the payroll tax receipt the authority divided in to parts, one is to issue before the payment is done and the other is after the payment is done but limited after the payment day as per the number of employees or assimilate to wages as it is shown in the following chart:

We should consider that the payments made to the employees could be by different benefits, salary, extra hours, Christmas bonus, vacations, premium vacation, fringe benefit, saving funds, pensions, severances etc. This concepts should be identify as an individual and independent for each employee as some of the concepts may be exempt in their entirety or up to certain amount in accordance to Law and Tax regulations in the Income Tax Law

If you have any doubts or questions, please do not hesitate to contact us.